Introduction/Background

There are numerous amounts of research and evidence revealing that stock prices can be predicted and are affected by various aspects of daily life, which can ultimately help an investor. One such aspect of daily life is news, where general news occurring around the world and in the country can affect the movement of certain stocks directly and indirectly. However, the bulk of research in this field focuses on financial news, rather than news as a whole. With this in mind, our team set out to analyze the immediate change of stock prices as a reaction to general news stories. We chose to apply our models to Apple stock (AAPL) for this project because it represents a fairly stable stock and is heavily traded.

Problem Definition

This machine learning project is centered around analyzing news stories to predict the movement of Apple (AAPL) stock prices in the market. Research has shown that adding in predictors such as news stories and social media posts (ex: Twitter) makes significant improvements to the quality of stock price predictions (Vanstone et al., 2019). As mentioned, for this project, we looked specifically at AAPL due to its relative stability and heavy trading. Instead of purely looking at financial news or Apple-related news, our models utilized general news as a whole. We also had some models that included the Dow Jones Industrial Average information as a market index that captures the general market trend to see if combining general news with this financial data would provide a better prediction of prices. Furthermore, rather than simply predicting the rise and fall of AAPL (information which could help an investor decide whether or not to buy or sell shares), our models were designed to predict the exact prices (which would reveal more information to an investor compared to a prediction of only rise or fall). Ultimately, we sought to create models that would accurately predict the prices of AAPL which could be used as a tool for people and companies to aid them in their investment decisions.

Data Collection

We obtained our news article data from the NYT Developer API, taking the NYT archive data from January 2016 to

December 2020. By feeding the month and year to the API, we get JSON with an array of all articles from that

particular month. Rather than the full raw text of all the articles, we receive the metadata from these articles

such as headlines, abstract, and keywords. Thus, the NYT data was already relatively clean and extensive data

cleaning wasn’t needed. It was helpful to use the cleaned data rather than raw text from all the articles to avoid

storage and computing issues in our model. To obtain AAPL data, we used the yfinance library to access historical

financial AAPL stock data from Yahoo Finance from December 2015 to January 2021 (we added these two extra months to

account for price changes from January 2016 to December 2020). Though this data was also relatively clean, we still

had to perform some data cleaning and preprocessing before our data was ready. For example, we added extra features

to the Apple data that were not present in Yfinance like the percent change for a day. We also removed the news

article data from days the stock market was not open, including weekends and holidays, to ensure our model was using

the appropriate data.

The content of interest in the NYT news articles was the abstract. We decided to use BERT because “it’s conceptually

simple” and “obtained new state of the art results on … NLP tasks” (Devlin et al., 2019). In order to semantically

and contextually represent the abstract using BERT, it underwent some pre-processing. The given abstract was treated

as a single segment of data. After adding the classifier and separator tokens, the abstract was tokenized using

built-in tensorflow extensions for BERT. Tokenization involves converting all words into BERT tokens, and split up

any OOV (Out-of-Vocabulary) words into smaller tokens, prefixes, and suffixes. After tokenizing the data, it was

converted to indices to represent each token as an entry in BERT vocabulary, which is the reference index for BERT

to get the unique word embedding for the given vocabulary word.

Methods

By manipulating word and document embeddings generated by BERT for each news story abstract for a single day, a 768

dimension vector can be obtained, which is referred to as the “daily embedding” for the given day. The daily

embedding encapsulates the information from news stories on all given days into a R768 space. However, when dealing

with over 69000 new stories from several years, 768 features impose a great toll on computing power and memory at

disposal. As a result, the daily embeddings need to go through data reduction before inferences can be drawn from

them.

Accounting for 95% variance for features of all 69404 news stories in the dataset yields a staggering 83%

compression in space occupied by reducing the 768 dimensions to just 131. We were also able to reduce the thousands

of news stories by averaging all the vectors for a specific day. This lets us move from 69,000 data points to 365.

Following dimensionality reduction, the evolution of content in news stories is compared to the evolution of the

market for AAPL to look for trends within. Since the content of news on different days as well as market behavior

trends are spread across timelines, one could use LSTM (Long Short Term Memory) models, which are known for their

efficiency in time series. By training and testing the LSTM networks, the general trend of AAPL could be predicted.

For the LSTM networks, we utilize three LSTM layers and two drop out layers, and use ReLU(Rectified Linear Unit) as

an

activation function. We split the data into training and testing data with 8:2 ratio and scaled it with

MinMaxScaler of sckit-learn package since each feature has a different range. Then we trained our models with epochs

of 20

and batch size of 32.

$$ x' = \frac{x - min(x)}{max(x) - min(x)} $$

[Equation 1: min-max scaler]

Results and Discussion

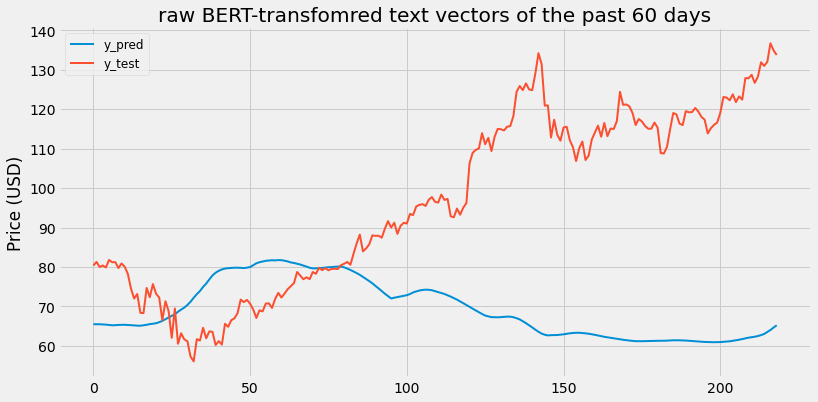

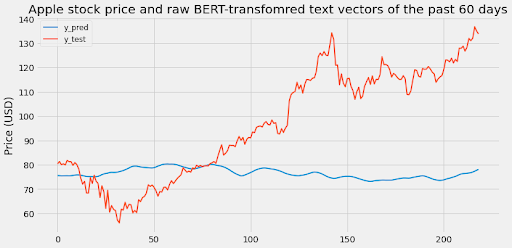

1. LSTM with BERT-transformed NYT article abstracts of the past 60 days.

1.a. Raw BERT-transformed NYT article abastracts

-

Train feature data size:

(819, 60, 768) -

Train label data size:

(819,)

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm_75 (LSTM) (None, 60, 10) 31160

_________________________________________________________________

dropout_75 (Dropout) (None, 60, 10) 0

_________________________________________________________________

lstm_76 (LSTM) (None, 60, 20) 2480

_________________________________________________________________

dropout_76 (Dropout) (None, 60, 20) 0

_________________________________________________________________

lstm_77 (LSTM) (None, 30) 6120

_________________________________________________________________

dropout_77 (Dropout) (None, 30) 0

_________________________________________________________________

dense_25 (Dense) (None, 1) 31

=================================================================

Total params: 39,791

Trainable params: 39,791

Non-trainable params: 0

[Figure 1.1: LSTM with raw BERT-transformed NYT article abstracts of the past 60 days.]

Scaled RMSE: 0.48106433548771926

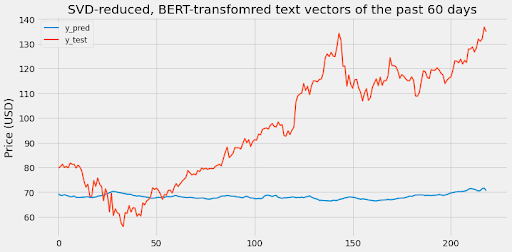

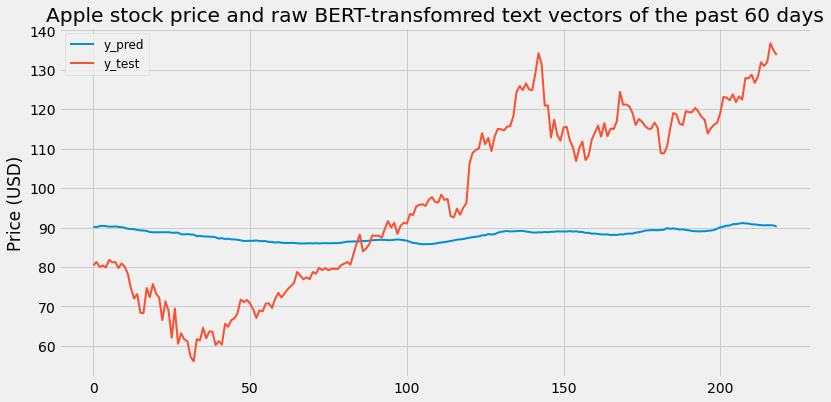

1.b. Dimension-reduced BERT-transformed NYT article abastracts

-

Train feature data size:

(817, 60, 127) -

Train label data size:

(817,)

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm_69 (LSTM) (None, 60, 10) 5520

_________________________________________________________________

dropout_69 (Dropout) (None, 60, 10) 0

_________________________________________________________________

lstm_70 (LSTM) (None, 60, 20) 2480

_________________________________________________________________

dropout_70 (Dropout) (None, 60, 20) 0

_________________________________________________________________

lstm_71 (LSTM) (None, 30) 6120

_________________________________________________________________

dropout_71 (Dropout) (None, 30) 0

_________________________________________________________________

dense_23 (Dense) (None, 1) 31

=================================================================

Total params: 14,151

Trainable params: 14,151

Non-trainable params: 0

[Figure 1.2: LSTM with reduced BERT-transformed NYT article abstracts of the past 60 days.]

Scaled RMSE: 0.44102269317574305

From these two graphs, it’s clear that relying solely on text vectors to predict stock data leads to a bad result. This makes sense because additional features like stock prices and economic trends are required to get a more accurate prediction. The goal of our model is to see how text vectors integrate with other features so let’s check that out now.

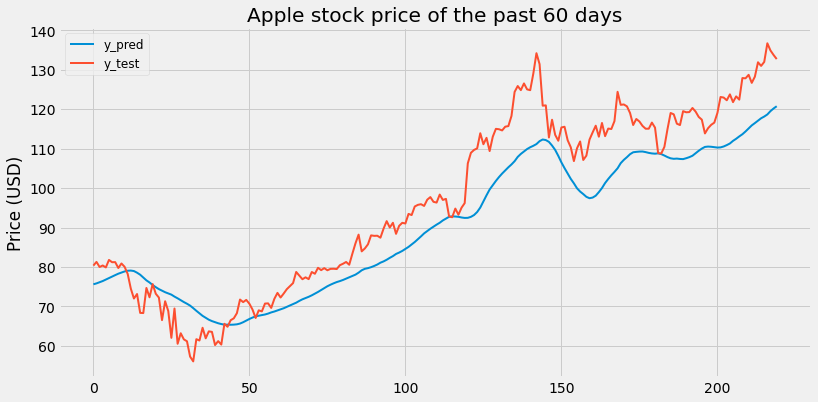

2. LSTM with historical price of the past 60 days

2.a. LSTM with historical APPL price of the past 60 days

-

Train feature data size:

(820, 60, 3) -

Train label data size:

(820,)

Layer (type) Output Shape Param #

=================================================================

lstm_6 (LSTM) (None, 60, 10) 560

_________________________________________________________________

dropout_6 (Dropout) (None, 60, 10) 0

_________________________________________________________________

lstm_7 (LSTM) (None, 60, 20) 2480

_________________________________________________________________

dropout_7 (Dropout) (None, 60, 20) 0

_________________________________________________________________

lstm_8 (LSTM) (None, 30) 6120

_________________________________________________________________

dropout_8 (Dropout) (None, 30) 0

_________________________________________________________________

dense_2 (Dense) (None, 1) 31

=================================================================

Total params: 9,191

Trainable params: 9,191

Non-trainable params: 0

[Figure 2.1: LSTM with historical APPL price of the past 60 days]

Scaled RMSE: 0.11442445233714693

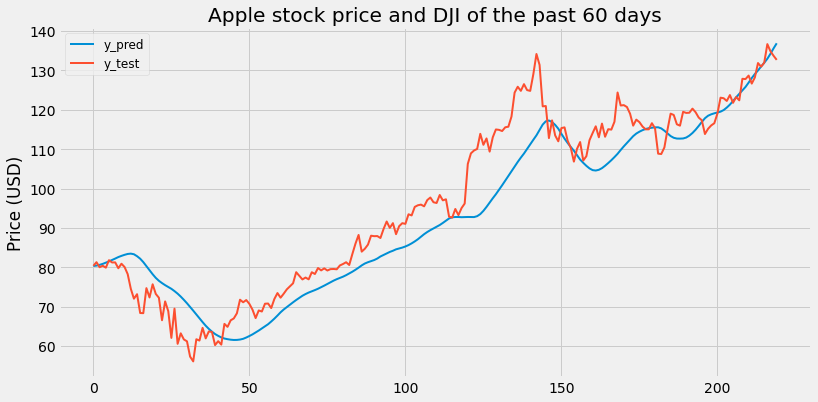

2.b. LSTM with historical APPL price and Dow Jones Index of the past 60 days

-

Train feature data size:

(820, 60, 4) -

Train label data size:

(820,)

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm_24 (LSTM) (None, 60, 10) 600

_________________________________________________________________

dropout_24 (Dropout) (None, 60, 10) 0

_________________________________________________________________

lstm_25 (LSTM) (None, 60, 20) 2480

_________________________________________________________________

dropout_25 (Dropout) (None, 60, 20) 0

_________________________________________________________________

lstm_26 (LSTM) (None, 30) 6120

_________________________________________________________________

dropout_26 (Dropout) (None, 30) 0

_________________________________________________________________

dense_8 (Dense) (None, 1) 31

=================================================================

Total params: 9,231

Trainable params: 9,231

Non-trainable params: 0

[Figure 2.2: LSTM with historical APPL price and Dow Jones Index of the past 60 days]

Scaled RMSE: 0.09475997994308416

Looking at previous Apple stock prices and the DJI leads to a good prediction of Apple stock. With a 91% accuracy, the predictions are already very satisfactory. Now let’s see whether incorporating text vectors improves the performance.

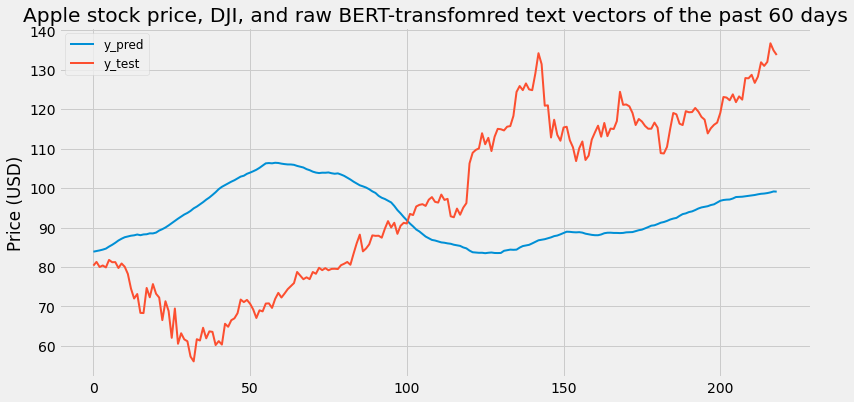

3. LSTM with historical price of the past 60 days and raw BERT-transformed NYT article abastracts.

3.a. LSTM with historical APPL price of the past 60 days and raw BERT-transformed NYT article abastracts.

-

Train feature data size:

(819, 60, 771) -

Train label data size:

(819,)

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm_45 (LSTM) (None, 60, 10) 31280

_________________________________________________________________

dropout_45 (Dropout) (None, 60, 10) 0

_________________________________________________________________

lstm_46 (LSTM) (None, 60, 20) 2480

_________________________________________________________________

dropout_46 (Dropout) (None, 60, 20) 0

_________________________________________________________________

lstm_47 (LSTM) (None, 30) 6120

_________________________________________________________________

dropout_47 (Dropout) (None, 30) 0

_________________________________________________________________

dense_15 (Dense) (None, 1) 31

=================================================================

Total params: 39,911

Trainable params: 39,911

Non-trainable params: 0

[Figure 3.1: LSTM with historical APPL price of the past 60 days and raw BERT-transformed NYT article abastracts]

Scaled RMSE: 0.3808984939602866

3.b. LSTM with historical APPL price and Dow Jones Index of the past 60 days and raw BERT-transformed NYT article abastracts.

-

Train feature data size:

(819, 60, 772) -

Train label data size:

(819,)

Layer (type) Output Shape Param #

=================================================================

lstm_36 (LSTM) (None, 60, 10) 31320

_________________________________________________________________

dropout_36 (Dropout) (None, 60, 10) 0

_________________________________________________________________

lstm_37 (LSTM) (None, 60, 20) 2480

_________________________________________________________________

dropout_37 (Dropout) (None, 60, 20) 0

_________________________________________________________________

lstm_38 (LSTM) (None, 30) 6120

_________________________________________________________________

dropout_38 (Dropout) (None, 30) 0

_________________________________________________________________

dense_12 (Dense) (None, 1) 31

=================================================================

Total params: 39,951

Trainable params: 39,951

Non-trainable params: 0

[Figure 3.2: LSTM with historical APPL price and Dow Jones Index of the past 60 days and raw BERT-transformed NYT article abastracts]

Scaled RMSE: 0.32082032270116007

Surprisingly, adding Daily Embeddings from BERT significantly decreases the performance of the model and rarely predicts correctly. One of the main reasons that happens is because 768 features is too high for a small dataset such as the one we are using. When using sparsely populated features, one needs significantly more data as compared to the features.

4. LSTM with historical price of the past 60 days and dimension-reduced BERT-transformed NYT article abastracts

4.a. LSTM with historical APPL price of the past 60 days and dimension-reduced BERT-transformed NYT article abastracts

-

Train feature data size:

(817, 60, 130) -

Train label data size:

(817,)

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm_78 (LSTM) (None, 60, 10) 5640

_________________________________________________________________

dropout_78 (Dropout) (None, 60, 10) 0

_________________________________________________________________

lstm_79 (LSTM) (None, 60, 20) 2480

_________________________________________________________________

dropout_79 (Dropout) (None, 60, 20) 0

_________________________________________________________________

lstm_80 (LSTM) (None, 30) 6120

_________________________________________________________________

dropout_80 (Dropout) (None, 30) 0

_________________________________________________________________

dense_26 (Dense) (None, 1) 31

=================================================================

Total params: 14,271

Trainable params: 14,271

Non-trainable params: 0

[Figure 4.1: LSTM with historical APPL price of the past 60 days and dimension-reduced BERT-transformed NYT article abastracts]

Scaled RMSE: 0.2837049092158715

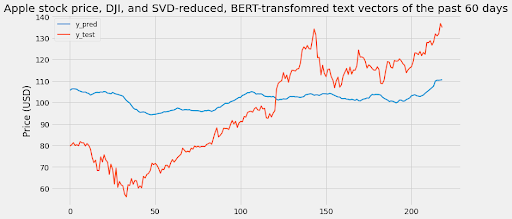

4.b. LSTM with historical APPL price and Dow Jones Index of the past 60 days and dimension-reduced BERT-transformed NYT article abastracts

-

Train feature data size:

(817, 60, 131) -

Train label data size:

(817,)

________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm_81 (LSTM) (None, 60, 10) 5680

_________________________________________________________________

dropout_81 (Dropout) (None, 60, 10) 0

_________________________________________________________________

lstm_82 (LSTM) (None, 60, 20) 2480

_________________________________________________________________

dropout_82 (Dropout) (None, 60, 20) 0

_________________________________________________________________

lstm_83 (LSTM) (None, 30) 6120

_________________________________________________________________

dropout_83 (Dropout) (None, 30) 0

_________________________________________________________________

dense_27 (Dense) (None, 1) 31

=================================================================

Total params: 14,311

Trainable params: 14,311

Non-trainable params: 0

[Figure 4.2: LSTM with historical APPL price and Dow Jones Index of the past 60 days and dimension-reduced BERT-transformed NYT article abastracts]

Scaled RMSE: 0.2613873171396424

When reducing the data through SVD, the performance slightly increases since the number of features decrease. However, the existing 131 features are still sparsely populated and are therefore the leading cause of discrepancy in prediction. For 70000 data points, one should have much fewer features. For 131 dimensions to represent all features, one should have a lot more data points. Since the representation of text content has several features, it fails to help our model despite the state of the art accuracy in its niche field.

Conclusions

Though our models may not be the best predictors of Apple stock price to help investment decisions, there are

various factors that could have caused the error in predictions for our models. One of these factors is that

accurate stock price prediction models require a large amount of data, and a lot of different types of data. While

our models only took into account general news data, previous AAPL stock price data, and the Dow Jones Industrial

Average to capture market trends, there are a plethora of other aspects of daily life that largely influence stock

prices that we did not account for. Furthermore, news tends to be negative. Therefore, our predictions could have

been inaccurate due to the news being overly negative, which would cause the news sentiment data to inaccurately

represent the general sentiment of society.

Additionally, stock prediction is quite a difficult task. Various financial institutions expend billions of dollars

to improve their prediction algorithms because these prediction algorithms can be extremely useful when making

investment decisions. The COVID-19 pandemic also could have influenced our results, because this pandemic has

affected stock prices and has been the center of the news for the past year.

Ultimately, there are many options for us to fine-tune our models to improve stock price predictions. By doing more

research on the effects of news on stock prices, and to what degree news affects stock prices, our models may

improve. In addition, we could experiment with more stock data and note how prediction accuracy changes with

different levels of emphasis placed on specific features of stock data and news data in an attempt to improve

results. Overall, though our current models may not be a great resource to base investment decisions upon, our group

has deeply broadened our knowledge of machine learning models and their importance in the field of finance and

investing.

References

- Vanstone, B. J., Gepp, A., & Harris, G. (2019). Do news and sentiment play a role in stock price prediction? Applied Intelligence, 49(11), 3815–3820. https://doi.org/10.1007/s10489-019-01458-9

- Devlin, J., Chang, M.-W., Lee, K., & Toutanova, K. (2019, May 24). BERT: Pre-training of Deep Bidirectional Transformers for Language Understanding. arXiv.org. https://arxiv.org/abs/1810.04805?source=post_page.